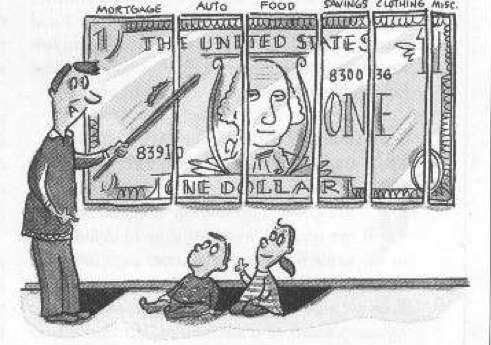

Talking about Debt to my five year old?

It’s funny, but talking about money with my kids is not as hard as I thought it would be. Teaching them about money, making money, managing money, investing and debt – has turned out to be kind of simple and fun. Even my five year old understands that debt is bad for you.

We were eating lunch this last Saturday and I mentioned to my wife about some money issues and my son just jumped into our conversation and said: “dad I don’t want debt, debt is bad right?” he was so cute. I was glad that the game [ cash flow for kids ] was having a positive effect on him.

Yes he is only five and he doesn’t understand that sometimes you can’t buy things without using debt [ home , car, etc ] or that there is a difference between bad debt and good debt – but the goal of teaching him sound financial knowledge at an early age seems to be a success [ even if it’s a small step ].

Teaching children Financial knowledge [ about money ] We have been talking [ my daughter and I ] on the subject of money, how to manage it, not just how to save and budget but on how to make it. She already has a jewelry business she is trying to start. We play cash flow for kids as a family, so my five year old has a chance to learn some basic principals as we the family share some time together. But the goal is basically to teach my kids about money – the first step being that I change how I handle money and learn more on the subject in order to teach them how to manage and make money.

We have been talking [ my daughter and I ] on the subject of money, how to manage it, not just how to save and budget but on how to make it. She already has a jewelry business she is trying to start. We play cash flow for kids as a family, so my five year old has a chance to learn some basic principals as we the family share some time together. But the goal is basically to teach my kids about money – the first step being that I change how I handle money and learn more on the subject in order to teach them how to manage and make money.

I guess the basic thing we as parents who want to teach our kids about money have to remember and learn is that it is a life long process. It took me years to get where I am; it’s going to take years to teach my children how to manage money correctly, make money and to be financially savvy. After all, I have been messing up financially for 30 years – can’t expect to change over night – can’t expect them to learn everything over night.

That is why I think using games as teaching tools and using family life experiences as an opportunity to teach is a better way than just letting my child sit alone reading a book on finances and making money.

Learning thru games cash flow for kids and new Monopoly City I was reading some blogs on how to teach your child about money – many simply focus on teaching your kids about money thru budgeting, spending wisely – but very few hit the subject of building a business, finance. I did run across an article about a teacher who has a high school class that he teaches them about stocks, investing, building a business – but I think you have to start at an earlier age.

I was reading some blogs on how to teach your child about money – many simply focus on teaching your kids about money thru budgeting, spending wisely – but very few hit the subject of building a business, finance. I did run across an article about a teacher who has a high school class that he teaches them about stocks, investing, building a business – but I think you have to start at an earlier age.

I am actually excited about the new monopoly game – my daughter turned me onto it. It looks fun, a bit more complicated than the old version and a good way of teaching thru playing games.

It is fun but also hard work to teach kids about money

Now I know I make it sound simple – teaching kids about money – wow it’s so easy – not so. It takes as much work as everything else in life. You have to learn the subject, find interesting ways of teaching the subject, find the time to prepare and find the time in a busy families day to sit an actually teach the subject of money to a child. Plus on top of all that you struggle with distractions from yourself, your children who always have a knack for putting things off and your own self insecurities.

I can not tell you that it is easy and I don’t want to give that impression – but if something is important to you, you push yourself forward, you do what you have to – to get it done.

On a side note: Remember the post on “paying yourself first” – I started doing just that last month. So far I have $500 dollars put away for investing or starting a business - $500 dollars I thought I didn’t have before. Ofcourse it does obligate you to choose what is more important and if necessary – find a way to make extra cash to pay for bills and luxuries – instead of thinking “hey I ran out of money at end of month so no savings “….

Talking about Debt to my five year old?

Subscribe to:

Post Comments

(

Atom

)

No comments :

Post a Comment