You can make money with stocks in the long run - your children have the time.

I was speaking with an older gentlemen the other day and he was explaining to me how he was retired from AT&T before it was broken up by the government. He explained to me how he now owns stock in AT&T, Verizon, Sprint and many other “phone” companies because he was smart enough to put his retirement fund at his job to buy stocks.

After the years went buy and the government broke up Ma Bell [AT&T] he just keep getting stocks every time a new company was split off. Now he is 65 years old and receives high devidens from all these companies. He laughed as he said that several times he received checks for $2000 dollars on several occasions in the year because the companies were merging and splitting and merging again... He advised me that I should buy good stocks and hold on to them.

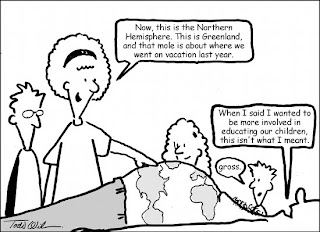

How do you teach your children the importance of investing?

In a simple fashion they can understand?

The goal is not to invest for them, but teach them how to manage money, make money and how to invest thier money. So when thier grown they can do it - and take care of you when your old :)

Here is how I started:

How Does Money Grow?

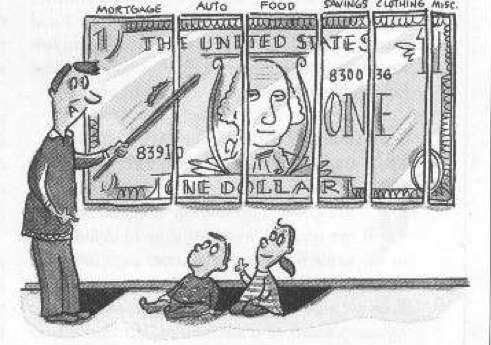

Investing is a way to make money with your money. First, you have to earn money. As a kid, you get money from allowance, gifts, services, or from selling goods such as lemonade or small business. Try to save some, if not all of this money. The next step is to make your money grow through investing. The chart illustrates this process.

Why Should I Invest?

There are two main reasons why you should invest:

* To stay ahead of inflation

* To achieve financial goals

Inflation causes the increase of prices. When a Big Mac goes up from $1.20 to $1.50 or when gas goes up from $1.30 to $1.70 a gallon, we say that is inflation. You need to make more money just to keep up with the rising cost of living.

Financial goals can be separated into two types:

* Short-term goals - Things that you need or want now or within the year, such as a bike, a computer, or a video game. Generally, it takes less money to reach these short-term goals.

*Long-term goals - Things that you need or want in a few years or more, for example, going to college, buying a house, and even starting a business. Generally, these goals are expensive and require some planning.

When Should I Invest?

The earlier you start investing, the sooner you can reach your financial goals. Investing is like "planting" money. A small amount of money invested will often grow to a larger sum over time. You’ve heard the phrase, "Time is money." With investing, time also makes money.

What are the Risks?

Although investing can make money with money, the downside of investing is that there is a risk of losing your money.

The key to investing is to minimize the risk and to maximize the financial reward. For this reason, it is important to understand the many ways to invest money.

There are hundreds of ways to reduce risk - which have to be learned. That is why it is very important to always be learning and to work with smarter people than you are. People that are in the field you need to learn and understand, like stock brokers, day traders - all complicated terms for people who know and make money with stocks, bonds and all sorts of investing.

But the technical stuff comes later - first lets start small because learning also comes from doing. Also - only invest what you can afford to lose. Don’t bet the grocery money or the mortgage payment.

To start investing first save.. Save your income [ allowance, gift, earned income thru chores and etc.] and split it into three saving banks [ pools ].

1- saving long term [ can be split in 2 - short and long ]

2- saving charity, giving

3- saving money to invest [ money that can be lost with out you going hungry ]

While your investing money [ #3 ] grows, learn about the companies you like, are interested in, how to invest, become friends with brokers and day traders and etc.. When you reach that specified number [amount] open an account and start investing.[ you may lose money - but that is part of the learning process ].

Simple way to teach your kids how & why to Invest

The importance of money, business & investing Early

I was sitting with a few friends at a group picnic that my local church was having. The sun was shinning, the weather was mildly cool for Florida and people were having fun. Then a friend of mine started complaining "I have to leave early, I have to go clean my house - I haven't had time to do anything at home." Another friend sitting by us asked her why - so she went on to explain that she runs a cleaning service and she's been real busy cleaning other people’s homes and hasn't had anytime to do any of her own things.

I couldn't help it, I just had to chime in and ask why didn't she expand, grow her business, have people work for her? She went on to explain "it's too much work. I tried it before and I can't find the right people that can do it as good as I want or like me. Besides my clients trust me and only want me - I would have to do commercial business to do that." At first I tried to explain to her that hard work [ working by herself ] and hard work managing people [ having people working for her ] is still hard work, except that she would have more free time and she would be able to enjoy days like this picnic rather than wasting it doing more work at home. It didn't work.

She politely said she appreciated the advice and that I was right, but - "it's just too much work" for her, she went on to give me a long list of excuses. That's when I realized that no matter what I said to her - she was not going to budge or change her way of thinking. Even though she was tired, over worked and complaining that she had no time for herself and family - she didn't want to put in the extra effort to improve her situation.

Why teach your children about money, business, investing at an early age

Children have something that most adults don't have - it's called options. Once your set in your ways it's hard to change. Once your an adult with bills, children, a dead end job - it becomes very difficult to make changes to your life or to take [ what adults consider ] risks.

But children have options because their young, they have time and freedom on their side [ mom & Dad pay the bills ]. While most parents are busy asking their kids "what will you do when you grow?" we forget to teach them that they have a world of opportunities. Opportunities they can take advantage of if they simply learn how to manage money, invest money and time in a business. No one says there is a set rule on how to do anything in life. If your child wants to be a doctor - fine, great, learn and prepare to be a doctor. But does that mean a doctor can't also have a business?

What of instead of a doctor only working for a hospital, the doctor opens his own office? Then that same doctor opens other offices and has new doctors needed experience to work in those offices? Then that same doctor buys a coffee shop, a gas station and then after 15 years with several businesses, the doctor retires. Then that same doctor just spends his days managing the business from a golf course he enjoys to play at?

It's not wishful thinking; the above mention hypothesis is real. It's a short synopsis of a doctor I know in my home town in Florida.

Teach your kids about their opportunities not get rich dreams

My daughter is currently twelve years old and I've been talking and teaching her about her options. That she could do more, be more, achieve more than her old man [ me ]. That is if she wants, she doesn't have to be just an employee, she can be the boss - that being an owner gives you more freedom, liberties, opportunities.

My daughter is currently twelve years old and I've been talking and teaching her about her options. That she could do more, be more, achieve more than her old man [ me ]. That is if she wants, she doesn't have to be just an employee, she can be the boss - that being an owner gives you more freedom, liberties, opportunities.When she came home last summer from New York, she came back with a jewelry making hobby - we've tried to convert that hobby into a business [ opportunity to teach ]. This weekend she had her first sale, she was excited. It was her first tangible lesson about business. Her work had paid off; her struggle to push her shyness aside, to show her jewelry and actually make a sale cemented in her that what she was doing was not just wishful thinking. She could make money with her business, it was no longer just a hobby - it's an opportunity.

I am not trying to teach my child that being rich is better. I do not want her to look for the next "get rich scheme" only to be scammed. What I want is for her to understand that she has options, opportunities that are hers. That because she is young she has time to learn not just a profession but the knowledge necessary to be more than just another employee in a see of millions - but a business owner, an investor. That because she is young she can learn to make money, manage her money, build or buy a business, invest wisely and take calculated risk that will give her more opportunities and more options in life.

Do you want to work hard or work hard ?

As I said, I was trying to explain to my friend that there is no difference between working hard and working hard. What I mean is - that if she works hard to get by and complains that she is tired, overworked and has no time - it's no different than her working hard to build a business, manage people to work for her and dealing with all the hardships of being an owner.

The only difference between "hard work" as an employee [ or slave to a job ] and "hard work" managing a business that has others working for you, is that you have options.

If you’re trapped in a job your boss tells you when you work, how much you work and how much you will get paid. If you work hard to build a business that grows to where people work for you - you decide when you work, how much you make and if you even want to work...... to quote the bible: Jesus said "The poor you will always have with you" .

Now you may have a good job, lots of bills and feel like your doing ok. If that's what you want, good - as long as your happy. But if you want more and feel trapped and can't seem to get anywhere... like if you don't have any options. Why not teach your child that they do have options, opportunities and start today?

your child needs to learn how to read a cash flow statement if they want to be rich?

Cash Flow and the need to teach kids about money

Last night was more of a lesson to me about the need for children to learn about money, cash flow and how to make money than it was to the kids? I was really surprised.

Last night my daughter had a friend who was sleeping over - we didn't get a chance to play cash flow for kids last Wednesday night so I told her we were going to play this Friday night [ friend or not ]. Which she didn't mind.

After a few minutes of simple instructions on how to play the game - her friend, my daughter and my five year old started the game. After a few rolls of the dice my "girl' excited son was spilling the beans... "the way to win is not to get debt and get money" [ his interpretation of passive income ]. At first I was surprised how my daughters friend who we will call "silly" did not seem to understand the basics of the game. I kept jumping in to help her understand that the name of the game was to create income [ passive income ] thru building business' and other financial venues. It took a while but she started catching on.

It's so easy a caveman can do it

I love the Gieco commercials where they make fun of the caveman - you know: "it's so easy a cave man can do it". Well, even though silly was not yet understanding the concept of the game, she applied the time tested tradition of "monkey see, money do" method. Once she saw that by buying a business or investing can generate extra money - see cuaght on to the game. It surprises me to see how when you compare what these kids are learning today - buy this, get it now and "credit" is the answer to everything - no wonder we have so many people facing poverty. The sad thing is - "silly" my daughters friend said - "If I go broke when I grow up I'll just marry a rich old dude"... I couldn't tell if she was joking or not?

It surprises me to see how when you compare what these kids are learning today - buy this, get it now and "credit" is the answer to everything - no wonder we have so many people facing poverty. The sad thing is - "silly" my daughters friend said - "If I go broke when I grow up I'll just marry a rich old dude"... I couldn't tell if she was joking or not?

Granted my daughter has read most of "Rich Dad Poor dad" and has played the game atleast 8 times by now - it still disturbed me how this young girl had no clue how to manage money or why building a business was better than just working at a job.... Ofcourse once she saw how fast her cash pile was growing when her "assets" [ meaning "business & Investment" ] were making her money - that even though she didn't understand the principal - she had no problem applying the principal in order to make more money in the game.

Easy way to teach kids about money [ cash flow ]

While reading the book "Rich Dad Poor" did make it easier for me to teach my daughter about money and to give her a simple understanding of how a "cash flow" statement works - you may want to take a different approach. Here is a basic simple definition I use:

Cash flow: is a report that shows how you make money and how you spend money. Plus it also shows you if you spend more than you make [ profit, break even or get further in debt ].

Why Cash flow is important: if you want to be rich or just live comfortable [ kids prefer "being Rich" theory ] you have to learn how to track your money so you know how to manage it. You need to know what makes you money so you can duplicate it. [ you can later teach about passive income verses earned income ] Cash flow - Asset or liability: I prefer to stick with rich dads definition - "an asset puts money in your pocket, a liability takes money out of your pocket".

Cash flow - Asset or liability: I prefer to stick with rich dads definition - "an asset puts money in your pocket, a liability takes money out of your pocket".

[ it's not about not buying nice things - it's about building a steady passive income first so your passive income pays for your nice things. We poor & middle class people work hard to buy nice things first and are overwhelmed by all our debts from our nice things... car, boat, furniture we soon replace a year or two down the road and we're still paying for...ten years later???]

** Even though I am an adult, like most parents I get a bit overwhelmed with trying to understanding all the complexities of finances, income statements, balance sheets and cash flow statements. My suggestion would be to teach thru a method that best suits your child. My daughter loves reading more than games - so I started with reading a book. Your child may be more hands on and may learn more easily through "interaction" with a game - use your judgment - but above all, their children so remember to keep it simple and at their learning pace.

Here is an adult version of the definition of the importance of cash flow:

Importance of Cash Flow Statement

A cash flow statement is a document that shows how much cash (or cash equivalents) comes into a business and how much goes out. A cash flow statement is considered a necessary companion to an income statement and a balance sheet when evaluating the financial condition of a business. A cash flow statement can be presented in several different formats. However, complete, concise and clear disclosure of the movement of cash is the only true requirement for a cash flow statement. Cash flow statements commonly cover periods of one year or more, with more or less detail, depending on the intended use of the cash flow statement. How to prepare a cash flow statement

Blank Cash Flow statement

here is a link to a blank PDF file of a cash flow statement for you to play with and use.

http://www.wflains.org/graphics/Monthly%20Cash%20Flow%20Statement.pdf

Online Games That Teach Kids About Money

Online games that teach kids about money

Teaching your kids about money can be fun - it can also be a long process but thankfully there are some board games and online games that can help you make it a more interesting and fun subject, especially for the younger kids that easily get distracted.

** If you know of any online games to help children learn about money, please feel free to share them with us.

Online Games That Teach Kids About Money

The internet is filled with fun games that teach kids about money. Below are links to some of our favorite games.

Planet Orange Discover Planet Orange, and open your eyes to the world of money! Brave the desert, climb mountains, and dodge alligators while you explore everything there is to know about earning, spending, saving, and investing. Source: Planet Orange

Practical Money Skills Games A number of addictive games from Visa that teach kids about money. Source: Practical Money Skills

Practical Money Skills Games A number of addictive games from Visa that teach kids about money. Source: Practical Money SkillsReality Check What kind of lifestyle does your child want? Have them answer these few basic questions and they'll be given a Reality Check. Source: Jump$tart

Savings Quest Interactive online budgeting game that tests kids' ability to save for the things they want while paying for all of the things they need. Source: Wachovia - Savings Quest

It All Adds Up Online games and simulations that teach kids about credit management, buying a car, paying for college, budgeting, saving and investing. Source: National Council on Economic Education

Escape From Knab Travelers stranded in the Cyberspace world of Knab must earn money and invest it wisely to get back home. Source: US Bank

FedVille Welcome to FedVille, a friendly town built just for kids where there is something to learn around every corner! Source: Federal Reserve Bank

H.I.P. Pocket Change A number of games from the U.S. Mint that teaches kids about currency and managing money. Source: US Mint

Fraud Scene Investigator Welcome to FSI: FRAUD SCENE INVESTIGATOR, an online interactive investor education program that teaches and empowers students how to detect and stop Source: NASAA

Bad Credit Hotel Have your child visit the Bad Credit Hotel, where a one night stay will teach them to control their credit. Source: Department of Treasury

The Financially Intelligent Parent

The Financially Intelligent Parent

by Eileen and Jon Gallo

“Mom, I need money for the dance. Money for the book fair. Money for my best friend’s birthday party. Money to go to the movies with my friends.”

For a parent, this conversation never seems to end. At what point do we have a solution to this problem of the desire by our children to receive an endless supply of money? At what point do we turn this demand for money into a lesson about money? Are you tired of trying to figure out how to teach your 14-year-old to manage money? Or, are you worried about how you are going to teach your 6-year-old to manage money as they grow older? If you are a parent and you have these concerns, then the lesson plan has arrived. The Financially Intelligent Parent is more than just a book. It is a collection of resources designed to teach parents how to educate their children to be responsible money managers.

Authors, Eileen Gallo, Ph.D., and Jon Gallo, J.D. are a husband-and-wife team who are experts on children, families and money. Eileen Gallo, Ph.D. is a licensed psychotherapist who works with individuals and families dealing with the psychological and emotional issues related to money, children and family wealth. Jo Gallo, J.D. is a nationally known estate-planning attorney. Their book, The Financially Intelligent Parent, identifies the eight key behaviors of financially intelligent parents:

1- Encourage a work ethic.

2- Get your own money stories straight.

3- Facilitate financial reflection.

4- Become a charitable family.

5- Teach financial literacy.

6- Be aware of the values you model.

7- Moderate extreme money tendencies.

8- Talk about the tough topics.

Each of these behaviors is the topic of one chapter in the book. Each chapter provides you with interactive exercises and checklists. You will be challenged to think about parenting and money in all new ways. The Gallo’s have worked with countless parents and, as a result, have many valuable stories to share. They will introduce you to parents that have made money mistakes with their children and parents that have managed money success with their children. You will find their stories touching and funny, but most of all identifiable. By recognizing yourself in one or more of the stories you will be able to relate to the tasks that must be accomplished as you seek to become a more financially intelligent parent.

The Gallo’s will not preach to you about what you should or should not do. Instead, they have a unique talent for allowing you to travel with them on this journey to becoming a financially intelligent parent. You will feel like you have found a friend who truly understands your desire to raise your children to be successful and responsible. A friend who not only understands, but is able to guide you in the right direction.

One of my most favorite chapters in the book is Chapter 8 – Teach Financial Literacy.

This chapter will teach you:

* Three Great Ways to Make Allowances Work for Your Kids

* The Art of Saving and Checking: How to Teach a Present-Oriented Kid to Think About the Future

* Introducing Your Child to Credit Cards

* Money-Management Opportunities for Children

This chapter is a perfect example of the entire book.

The Gallo’s don’t just tell you that you should teach your children to save money; instead, they tell you how to teach them to save money. They provide step-by-step instructions to guide you on your journey.

The Financially Intelligent Parent website is a tremendous resource and a great compliment to the book. You can sign up for their newsletter, participate in the community forums, and read articles written by the Gallo’s. For a small monthly fee, they offer a Financially Intelligent Parent membership which includes an allowance advisor, a chore chart, and more. For a limited time, use the promotion code NEW3 and receive 3-months free trial membership.

Read an excerpt from the book: Chapter 1 - The Money Beliefs of Financially Intelligent Parents

Talking about Debt to my five year old?

Talking about Debt to my five year old?

It’s funny, but talking about money with my kids is not as hard as I thought it would be. Teaching them about money, making money, managing money, investing and debt – has turned out to be kind of simple and fun. Even my five year old understands that debt is bad for you.

We were eating lunch this last Saturday and I mentioned to my wife about some money issues and my son just jumped into our conversation and said: “dad I don’t want debt, debt is bad right?” he was so cute. I was glad that the game [ cash flow for kids ] was having a positive effect on him.

Yes he is only five and he doesn’t understand that sometimes you can’t buy things without using debt [ home , car, etc ] or that there is a difference between bad debt and good debt – but the goal of teaching him sound financial knowledge at an early age seems to be a success [ even if it’s a small step ].

Teaching children Financial knowledge [ about money ] We have been talking [ my daughter and I ] on the subject of money, how to manage it, not just how to save and budget but on how to make it. She already has a jewelry business she is trying to start. We play cash flow for kids as a family, so my five year old has a chance to learn some basic principals as we the family share some time together. But the goal is basically to teach my kids about money – the first step being that I change how I handle money and learn more on the subject in order to teach them how to manage and make money.

We have been talking [ my daughter and I ] on the subject of money, how to manage it, not just how to save and budget but on how to make it. She already has a jewelry business she is trying to start. We play cash flow for kids as a family, so my five year old has a chance to learn some basic principals as we the family share some time together. But the goal is basically to teach my kids about money – the first step being that I change how I handle money and learn more on the subject in order to teach them how to manage and make money.

I guess the basic thing we as parents who want to teach our kids about money have to remember and learn is that it is a life long process. It took me years to get where I am; it’s going to take years to teach my children how to manage money correctly, make money and to be financially savvy. After all, I have been messing up financially for 30 years – can’t expect to change over night – can’t expect them to learn everything over night.

That is why I think using games as teaching tools and using family life experiences as an opportunity to teach is a better way than just letting my child sit alone reading a book on finances and making money.

Learning thru games cash flow for kids and new Monopoly City I was reading some blogs on how to teach your child about money – many simply focus on teaching your kids about money thru budgeting, spending wisely – but very few hit the subject of building a business, finance. I did run across an article about a teacher who has a high school class that he teaches them about stocks, investing, building a business – but I think you have to start at an earlier age.

I was reading some blogs on how to teach your child about money – many simply focus on teaching your kids about money thru budgeting, spending wisely – but very few hit the subject of building a business, finance. I did run across an article about a teacher who has a high school class that he teaches them about stocks, investing, building a business – but I think you have to start at an earlier age.

I am actually excited about the new monopoly game – my daughter turned me onto it. It looks fun, a bit more complicated than the old version and a good way of teaching thru playing games.

It is fun but also hard work to teach kids about money

Now I know I make it sound simple – teaching kids about money – wow it’s so easy – not so. It takes as much work as everything else in life. You have to learn the subject, find interesting ways of teaching the subject, find the time to prepare and find the time in a busy families day to sit an actually teach the subject of money to a child. Plus on top of all that you struggle with distractions from yourself, your children who always have a knack for putting things off and your own self insecurities.

I can not tell you that it is easy and I don’t want to give that impression – but if something is important to you, you push yourself forward, you do what you have to – to get it done.

On a side note: Remember the post on “paying yourself first” – I started doing just that last month. So far I have $500 dollars put away for investing or starting a business - $500 dollars I thought I didn’t have before. Ofcourse it does obligate you to choose what is more important and if necessary – find a way to make extra cash to pay for bills and luxuries – instead of thinking “hey I ran out of money at end of month so no savings “….

Teaching kids about money is Fun !

It all started with a simple game called "Cash Flow for Kids". I've been posting about my endeavors to teach my kids about money, how it works, hot to make money, manage money and most of all have money work for you.

Tonight [ Wednesday Oct. 7, 2009 ] at 5 pm I cracked open the game for the first time and started playing. It was me, the wife and the two kids. I quickly read over the rules and off we went.

The first life lesson from the Game

The first lesson my daughter learned from the game is that "life is not fair".Oh, she was happy and excited when she heard that she was receiving a salary of $1,000 dollars - "man that's a lot of money!" she blurted out in glee. But the shocker was when she learned that she had bills and expenses to pay as well. Every time she is paid she gets $1,000 dollars and then has to pay $700 dollars in expenses [ mortgage, electricity, etc...] She didn't like that.

"What, that's more than half my money! That only leaves me with only $300 dollars - that's not fair!?"

I explained to her that, that is life. "Don't forget, the minute you get paid in the real world, your uncle Sam taxes money away from you in government taxes. Then comes the bills and expenses - that is just how life really is." After a few minutes of hysteria and explaining the concept of the game - we started playing.

Second life lesson of Game - small adds up to a lot over time.

After a few turns my daughter learned her second life lesson - my wife was taking her turn, and she picked a card that gave her the opportunity to buy an investment. The investment would cost her $600 dollars but it would give her a recurring income of $10. Now I was the bank and my 5 yr olds helper so I simply watched the game and observed much of what was going on. My daughter quickly blurted out to her mom: " don't buy that investment it cost too much and you get only a little bit of money!" My wife was quickly taking the advice of my daughter so I explained to my was that it was her choice if she wanted the investment or not, but that every time she was paid her salary, she would also get an extra $10 dollars. My wife thought about it and then said " sure why not, it's not real money."

After a few turns my daughter learned her second life lesson - my wife was taking her turn, and she picked a card that gave her the opportunity to buy an investment. The investment would cost her $600 dollars but it would give her a recurring income of $10. Now I was the bank and my 5 yr olds helper so I simply watched the game and observed much of what was going on. My daughter quickly blurted out to her mom: " don't buy that investment it cost too much and you get only a little bit of money!" My wife was quickly taking the advice of my daughter so I explained to my was that it was her choice if she wanted the investment or not, but that every time she was paid her salary, she would also get an extra $10 dollars. My wife thought about it and then said " sure why not, it's not real money."I was surprised, that after all the reading my daughter and I have done and talked about - that she would so quickly turn down passive income. The funny thing is that the moment she notice that every time her mom got paid she received an extra $10 dollars - she changed her mind quickly about small investments. She realized that even though her initial investment was big $600, her long term returns added up over a long time would be great even if it was only $10 dollars at a time.

Yes it's just a game, but you can learn a lot from a game

Now yes, the game is for kids and it doesn't factor in stock market crashes, business failures and the reality of life’s "up & down's". But it does teach you a lot, the moment my daughter realized that she could make extra money by spending cash [ money on hand ] to purchase an investment that created a long term income - she couldn't stop buying. None of them could, even the 5 yr old who had very little knowledge of what he was doing. All he knew was that the green cards meant he could make more money if he agreed to buy them.

It's funny how the mind works, when it's a game, paper money, it is not that hard to step out and invest. But once your in the real world, some how paper money has more value, fear of loss attached to it and a completely different sense comes over you.

It's funny how the mind works, when it's a game, paper money, it is not that hard to step out and invest. But once your in the real world, some how paper money has more value, fear of loss attached to it and a completely different sense comes over you.The reason we fail in life is because we put so much pressure on ourselves and we allow fear of loss to take over logical thinking. But in the game - hey there is no real threat of loss, so we just act. During the game my wife said that we could do this because it was a game - but that in real life you need money to make money.

It's a lie: Need money to make money

When real estate was booming in 2005 & 2006 I learned a little bit about contracts, real estate and let's say - the art of a deal. I went out on a limb and placed a contract on a residential lot with no money for down or to purchase the lot. My wife thought I had gone mad. She was frantic with fear, concern, she just kept asking me "how are you going to pay for it, we have no money..." Swallowing my fear, I found a buyer that would take over the contract and at the end of the sale I ended up with $10,000 cash in my pocket. I did this two times in a span of 60 days - with no money, I made $20,000 dollars. Ofcourse now my wife wasn't asking me "how are you going to do this?" But now she wanted to know when I was going to do my next deal.

Then came the real estate bust and the credit crisis of banks - but I only mention this because I want to show you and remind my wife that "You don't need money to make money" - what you need is knowledge, opportunity and action.

Dealing with Kids is easier than Mom !

I’m not sure how or even why - but the conversation went from needing to fix a leaking pipe to - “Why don’t you love me the same anymore?”

I was confused and had to ask… What the….?

“You don’t love me the same any more. Before, If I asked you for something you would find a way to get it for me. Now you don’t… “ she replied.

Say what? Is all I could think of…

In all honesty, it is true that when we first were married I did do what ever it took to get her everything she wanted, the same for the kids when they were born - that is if it was possible.

What is the true reason behind it?

I explained to my wife that my love for her has not changed - infact the reason I do what I do is because I love her. We’ve been married 17yrs and I have given her most of all she has asked for [ and she never forgets to remind me of what I haven’t given her ] and after 17 years, we have nothing….

Our finances are a mess, savings are dismal, retirement plan is a virtual joke - unless you really believe social security will be enough for us to retire on [ if it’s still there that is ]. If I were to die today - who would take care of my family? Even if I lived to a ripe old age - who would take care of us?

The reason behind saving, trying to build wealth [ mainly assets that will create income for us to live on ] is because I love her. Because I want to supply her needs, even some of her wants, today, tomorrow and for as long as she lives. Because I save or cut down on waste doesn’t mean I don’t want to buy her things - it just means I have goals, priorities and I want to achieve those goals for us, the kids, for her.

The reason behind saving, trying to build wealth [ mainly assets that will create income for us to live on ] is because I love her. Because I want to supply her needs, even some of her wants, today, tomorrow and for as long as she lives. Because I save or cut down on waste doesn’t mean I don’t want to buy her things - it just means I have goals, priorities and I want to achieve those goals for us, the kids, for her.I am a Material Girl in a Material world

Madonna said it best when you describe the mentality of this generation: “I am a Material girl in a material World”. I am not sure how my wife equates the level of my love by how much stuff I buy her - but I sure hope the kids don’t have that same mentality.

I love my wife and my kids - while I try to turn my finances around, change the way my kids think about money and hope I can help them have a better life than I did…. I hope they realize that I do this for them. I strive, I work, I struggle and sacrifice for them. The only difference now compared to then is - instead of working pay check to pay check hoping I can afford all they want, I am working to build them a future, a business, a way of life.

I have been there done that.. 17 years of paying taxes, working hard, buying trinkets and I have less today than I had 17 years ago [ financially ]. I have more debt than I’ve ever had in my whole life today and my paycheck is not growing. In 1987 when the stock market crashed I said “I’m going to buy stocks and make some money" but I was afraid so I did nothing. The market bounced back and I kicked myself. In 1992 the stock market slumped again and I said "I’m going to buy stocks this time…" this time I had no money to invest. In 2007 the stock market crashed and AIG stocks were at $6 dollars. I told a friend I’m going to buy some AIG stocks… I did nothing, in Aug. 2009 AIG stock jumped to $40 dollars and I’m kicking myself again. Next time I will be ready and have the mentality and the free cash to invest.

If I could change the World

I think that song from Erick Clapton, where he sings “ If I could change the world “ sums it up best for how I feel about my family. I can’t change greedy corporations or the men that run them. I can’t change corrupt government or the over baring taxation we face. I can not change the cruelty of this world, but I can change the way my kids think. How they work with their hands, money and teach then how to have their money work for them. My kids can do what ever they want to do in life, but I know that they can’t say that dad didn’t try to teach them a better way. Instead of being an employee be the owner. Instead of buying junk, buy a business. Instead of being a slave to taxation - play by the governments rules and pay less taxes?

I think that song from Erick Clapton, where he sings “ If I could change the world “ sums it up best for how I feel about my family. I can’t change greedy corporations or the men that run them. I can’t change corrupt government or the over baring taxation we face. I can not change the cruelty of this world, but I can change the way my kids think. How they work with their hands, money and teach then how to have their money work for them. My kids can do what ever they want to do in life, but I know that they can’t say that dad didn’t try to teach them a better way. Instead of being an employee be the owner. Instead of buying junk, buy a business. Instead of being a slave to taxation - play by the governments rules and pay less taxes?There is only so much I can do with my life now, but I am hoping to give my kids the information, the mentality, the courage and the opportunity to do more, be better, enjoy the prosperity this great country promises everyone.

Work all your life for nothing ?

I sat my family down, even the five year old and announced - “it’s time we had our first family business meeting.” My wife looked at me as if I were crazy, my daughter gave me an excited expectant gaze ( we have been reading “Rich Dad Poor Dad” together for several days now ) and of course my five year old son just played with his toy cars at my feet.

Taking a page from Robert T. Kiyosaki’s book, I decided we the family should mind our own business. I have been working on improving my financial situation and to teach my children about money - So being a big believer in " a family that works together, stays together" I decided to involve the whole family. To be honest I have doubts when it comes to my wife and money [ terrible spender and money manager ] but I figured I would give her the benefit of the doubt and that this would helped to involve my children in the family financial process.

“ There is a big difference between your profession and your business. Often I ask people, “what is your business?” And they will say, “oh I’m a banker.” Then I ask them if they own the bank? And they usually respond. “No, I work there.”

In truth, my business is to teach my children about money, parents often never teach children about money - they leave it up to the school or life in general to teach children about money. I don’t want that for my kids. I want to teach my kids about money - I want them to know how to manage money, make money, make money work for them, even how to create money from nothing.

In truth, my business is to teach my children about money, parents often never teach children about money - they leave it up to the school or life in general to teach children about money. I don’t want that for my kids. I want to teach my kids about money - I want them to know how to manage money, make money, make money work for them, even how to create money from nothing.Our first Family business meeting

Like I said, our first family business meeting was called to order. I turned the TV off, gathered them around and went over some of the things I have been doing.

1- life insurance, how much, who is beneficiary.

2- Bank accounts, beneficiaries.

3- opened new account for kids

[ * goal to save $10,000 for each child by the time they turn 18 yrs old. I want more but lets start with a simple goal and work from there. ]

4- Went over my Daughters goal of creating and raising $1,000 by Oct. 31, 2010.

[ * she has to start a business, make money, manage it and save it. ]

5- My wife has to make extra money……..

“ ??? What….Why ??? ….”

Yes, that is when the business meeting really got lively. Emotions took over, fear lead my wife into panic mode. She started complaining that we can’t just save money, we have to live life too. She went on to say that she already works, that she can’t spread her money out any more. Then she cracked and started talking about “when are we going on vacation? What about the things I want, how will I buy my things?…”

Once the meltdown subsided I explained to my wife that the money she currently earns at her job will not be touched - But like my daughter and myself - if she wants extra things…. She’s going to have to come up with the extra money to get it. Plus - the goal is to make money, save and manage our money to buy assets that in turn make us more money.

Golden Years - Work all my life to have nothing ?

Earlier that morning we were watching the news before taking the kids to school and going off to work. There was a report on a special event in Tampa Florida that many banks were holding in order to help families who were losing their homes to Bank foreclosure. They talked with one particular sweet looking elderly woman and her husband… the elderly woman said “I worked all my life to get my dream home and retire… it looks like I worked all my life for nothing….” Between health problems and the bank foreclosure - this sweet elderly woman was losing everything she worked hard all her life for.

Earlier that morning we were watching the news before taking the kids to school and going off to work. There was a report on a special event in Tampa Florida that many banks were holding in order to help families who were losing their homes to Bank foreclosure. They talked with one particular sweet looking elderly woman and her husband… the elderly woman said “I worked all my life to get my dream home and retire… it looks like I worked all my life for nothing….” Between health problems and the bank foreclosure - this sweet elderly woman was losing everything she worked hard all her life for.I reminded my wife of the news report, of that sweet old woman and asked her… “Do you want to end up like that one day?” Her response was no. I know that life is full of unexpected disasters and misfortune… I can’t control that. But I can control how I work, manage my money and how I create my wealth. Do I buy a business and take a chance at the business failing or succeeding…. Or do we sit back and pray that Social Security will be enough to keep us happy in our golden age of life. Can you say - “Welcome to Wal-mart”… Because that’s where many are today who believed the government would take care of them when they retired.

Fighting against fear that stops Improvement

When the meeting was over and my wife and the five year old dispersed - I turned to my daughter and asked her “did you see what happened?”. I explained to her that Moms reaction was exactly what Robert speaks about in his book. That no matter how logical or smart a person may be - fear can trap them from doing what they know is right and best for them. That instead of being concerned about “How can we better prepare for our future?” Mom was more concerned about the fear of not buying extra shoes or not going on vacation. That fear caused her to have a defeatist attitude and she could not see a way out. That the minute she said “I can’t” her brain closed off to finding a solution to her problem.

When it comes to money or life in general - do not allow fear to consume you. To stop you from acting, changing, taking a chance [ logical thought out opportunity ]. I tried to convey to my twelve year old child - that life is full of adversity and challenges. Fear will cause you to freeze, cause you to avoid the hardship of overcoming a challenge to the soft comfort of the norm [ what you always do ].

I tried to to help her understand, like all parents should - that you should never say you can’t. Leave your mind open to opportunity - don’t say you can’t, ask yourself: How can I do this….