One of the reasons poor people are poor is because they have nothing to sell. The fact is that the minute you have something to sell, you can start making money. The art of selling is a skill that can help children financially and even with low self esteem issues.

I know what you’re thinking; putting a fragile child to sell products does not help with low self esteem issue – it would only hurt a child to have to face rejection. First lets be honest – selling is just part of every day life, so is rejection and how you deal with rejection.

I use to frown upon the girl and Boy Scout organization because they exploited children to sell cookies to raise funds. While I still believe their being exploited, I believe the experience can be a positive plus when it comes to life. Every person on earth is always selling something, selling themselves to potential friends, schools, colleges, jobs and vice versa, every day we are faced with rejection. Rejected in love, work promotion, friendships and more – how we deal with rejection and the skills we have when it comes to selling is what really makes some people stand out more than others.

Shy children need to learn how to sell

While I am not advocating some emotional training here, I am stating the fact that “selling” and I mean learning how to sell and overcoming rejection – can help a child with low esteem and could definably help a child’s financial future.

While I am not advocating some emotional training here, I am stating the fact that “selling” and I mean learning how to sell and overcoming rejection – can help a child with low esteem and could definably help a child’s financial future.As I wrote this, these two children walked into my office looking to sell some candy bars to help raise funds for a scholarship. I knew what they wanted because this is the third group that has come by here. The minute I said that a group had already come by here one of the girls said “Well you could give us a donation too” the second girl burst into a loud grunting compliant “Ah man dog, this sucks, this is a lousy Christmas….” Ofcourse It did not seem like they suffered from low self esteem, but their attitude [ as if entitled ] to receive something from me only proves that their lack of “selling skills” is what inhibits them from reaching success – a sale.

My daughter is generally a shy girl, she can be loud, boisterous, a regular pre-teen, but ask her to talk to strangers and she emotionally shuts down. As I have mentioned before in my blog I am trying to help her convert her hobby of making jewelry, into a jewelry business. This Christmas I told her that during Christmas break we [ meaning her and I will just accompany her ] were going to go door to door to try and sell her jewelry. She freaked, she said she could not do it. Apparently unbeknownst to me the last day of school was half a day and she was spending most of the day with her mother at work. My wife, always the "sneaky" individual decided to take the jewelry with her to work and she and my daughter sold all but one set and made $27 dollars in 40 minutes.

I would have preferred for my daughter to have done all the work by herself, but the lesson I was trying to instill in my daughter was successfully made. That while the fear of rejection can hold you back, the sweet smell of success will drive you even farther forward. At first she didn’t want to face rejection, she said “who would buy my jewelry”, but when I arrived home that night, she could not stop talking about how people liked her stuff and how much money she made. While this is just her first step in selling a product, it is a good first step. I have always taught my daughter that she had to be her own person, to believe in herself. This helped bring that lesson home, it was not just dad, but total strangers who approved of her, of her work and paid cash as proof.

Selling is a skill to be learned, honed and practiced

I do not have the space to go over all the techniques about how to sell, how to deal with rejection. But selling, understanding how to deal with people and rejection changed my life. I was a shy kid and even a more shy adult – I called it being a loner, but in reality it was my inability, my fear of dealing with people and having low self esteem [ lack of confidence ]. I was forced to sell when the only job I could find was in the retail business selling shoes. Then over the years retail [ selling ] has seemed to have stuck with me. Selling is partly knowing how to converse with people - many people today lack the simple skills to carry a conversation with others.

The basic’s of selling:

#1 - Know your product, is it good, do you believe in it?

When it comes to self-esteem, do as I did, I taught my child that she was special, not because she was better but just one of a kind. No one, no one at all can be her equal because there is only one of her, being different, unique, one of a kind keeps her special.

Does not matter what you are selling – the question should be, do you believe in it?

#2 – It is a numbers game do not take it personal.

A sales person should know and understand that not every one will love, accept and buy your product. Be that product a cell phone, a car or you yourself. People are different and have different wants needs and likes. A good sales person knows he/she has to offer a product 4, 7, 10 times before getting one sale. You have to keep trying.

#3 - Because they said no today they may say yes tomorrow?

People have needs and those needs change with time, often times it takes people a bit of time to even realize that they need something or that something they rejected is of use or to their benefit. The old saying is try, try and try again - never give up.

#4 - Presentation is key, likeability is a factor.

People never think of how they look, speak, act or even how they present themselves to others until it's too late. The first time most teenagers ever realize that how they present themselves is important is when they are trying to get accepted into a college or applying to a job. Ask any young man who is trying to impress his new girlfriends Dad, presentation, likeability, personality - it is very important.

#5 - Look, listen, understand then SPEAK?

One of the things they first taught me when I started any job or profession that required selling a product or myself was these simple tips: look, listen, understand then you speak.

If you want to start a conversation with some stranger [ to sell a product or make a new friend ] you have to:

a- look, if in a home at the decor, pictures so forth, if not in the home, at the person how they dress, act, speak present themselves.

b- Listen, be slow to speak and quick to listen. Listen to what they are talking about, get to know who they are, what they like, what interest them.

c- Understand; try to understand what and why they say what they are talking about. Understand their point of view and try [ it's a guessing game ] but try to keep their topic of conversation going if you know and understand it. Never try to pretend to know something you do not - people can tell a fake. Be honest and genuine about learning if you do not understand, most people like to know things and teach others.

d- Speak, people like to talk, and usually they speak too much. Learn how to look, listen, understand then speak. Plus always try to stay on topic, with in the current conversation. One of the flaws of most sales people is that 2 minutes into the conversation and they are throwing out their sales pitch. You have to learn about the people, let them get to know you to get comfortable with you and then you slowly begin to sell them.

Ofcourse there are some sales situations where a quick sales pitch is necessary - shoe store, cell phone, home depot and so forth. But in general with real estate, life insurance and making general friends it is best to follow the steps mentioned: look, listen, understand and then speak.

Why would my child ever need this selling technique?

You are probably wondering why a child would need to learn these "selling techniques"; he/she does not need this to help them make friends or to help them over come shyness.

Think of it as you like, but this would give your child a step up on all his/her friends. Even if your child is at ease and makes friends easily, what about college, job interviews, selling cookies or high school prom queen? One day your child will have to sell him/herself in order to sell a product or get a product or service. Maybe your child will need these techniques to simply win out a colleague at getting a scholarship, promotion or some other prize.

It's up to you; after all it is your child.

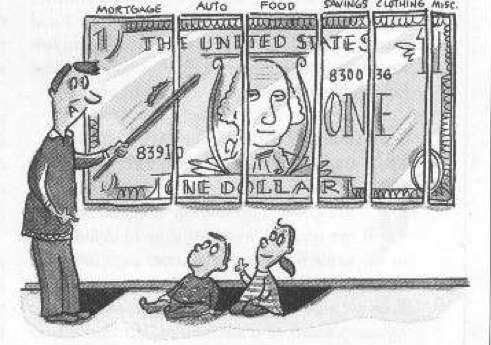

How can you expect to teach a child about money by simply making them work? All your doing is training them to be good employees for the rest of their lives. And if you try to teach them how to budget, how to live beneath their means - what does that say about you, all your unfulfilled dreams and wants? So if you give them allowance [ money ] free or if they earned it - what did you really teach them?

How can you expect to teach a child about money by simply making them work? All your doing is training them to be good employees for the rest of their lives. And if you try to teach them how to budget, how to live beneath their means - what does that say about you, all your unfulfilled dreams and wants? So if you give them allowance [ money ] free or if they earned it - what did you really teach them? The reason why you would chose the nickel over the quarter is because in truth the nickel is worth way more than the quarter. This should start the jaw flapping and questions flying.

The reason why you would chose the nickel over the quarter is because in truth the nickel is worth way more than the quarter. This should start the jaw flapping and questions flying.

My daughter wanted me to buy one of the other monopoly games because it came with a credit card machine so she wouldn’t have to count out the cash and do the math – but I said no. Why, because the point of the game [ from my point of view ] was to involved her brain, cause her to think, to exercise the biggest muscle she needs - brain matter.

My daughter wanted me to buy one of the other monopoly games because it came with a credit card machine so she wouldn’t have to count out the cash and do the math – but I said no. Why, because the point of the game [ from my point of view ] was to involved her brain, cause her to think, to exercise the biggest muscle she needs - brain matter. That payroll tax hike has generated about $2.5 trillion of surplus Social Security revenue to date. If the money had been saved and invested, as it was supposed to be, Social Security would be in good shape today. But the money was neither saved nor invested in anything. Instead, it has been used as a giant slush fund to pay for tax cuts, wars, and other government programs for the past 25 years. The government has "borrowed," or "stolen" every dime of the surplus Social Security revenue. If the government eventually repays the looted money, we can say that the government "borrowed" it, but, unfortunately, no provisions have been made for repaying the money. Furthermore, it may not be politically feasible to raise taxes for the purpose of replacing tax revenue that was misspent in the first place. If the looted money is never repaid, it will have clearly been "stolen" from American workers who paid the extra Social Security taxes.

That payroll tax hike has generated about $2.5 trillion of surplus Social Security revenue to date. If the money had been saved and invested, as it was supposed to be, Social Security would be in good shape today. But the money was neither saved nor invested in anything. Instead, it has been used as a giant slush fund to pay for tax cuts, wars, and other government programs for the past 25 years. The government has "borrowed," or "stolen" every dime of the surplus Social Security revenue. If the government eventually repays the looted money, we can say that the government "borrowed" it, but, unfortunately, no provisions have been made for repaying the money. Furthermore, it may not be politically feasible to raise taxes for the purpose of replacing tax revenue that was misspent in the first place. If the looted money is never repaid, it will have clearly been "stolen" from American workers who paid the extra Social Security taxes. He wasn't a salesman; he was a project manager for a company which installed fire alarms. "I managed crews that installed systems in high rises and hospitals," he explained.

He wasn't a salesman; he was a project manager for a company which installed fire alarms. "I managed crews that installed systems in high rises and hospitals," he explained.

Another reason why this is the time to teach your children about investing in stocks is because they can generate greater returns with “penny stocks”. Penny stocks basically means stocks that are trading below the five dollar mark. Some may be $4, $2 or even .56 cents – but they are all classified as penny stocks.

Another reason why this is the time to teach your children about investing in stocks is because they can generate greater returns with “penny stocks”. Penny stocks basically means stocks that are trading below the five dollar mark. Some may be $4, $2 or even .56 cents – but they are all classified as penny stocks.  But while I was online with my daughter playing this game about running your own business, I ran across something that helped me show my daughter that yes, you can use complicated math in everyday life situations. There we were trying to solve how we can figure out how to make a profit from selling ice cream. All of a sudden they were asking us for percentage, how to solve the problem of profit ( X = sale minus cost ). Can you imagine that - the math most kids hate and say they will never use in ordinary average everyday life being used to solve an everyday situation.

But while I was online with my daughter playing this game about running your own business, I ran across something that helped me show my daughter that yes, you can use complicated math in everyday life situations. There we were trying to solve how we can figure out how to make a profit from selling ice cream. All of a sudden they were asking us for percentage, how to solve the problem of profit ( X = sale minus cost ). Can you imagine that - the math most kids hate and say they will never use in ordinary average everyday life being used to solve an everyday situation.

After a few turns my daughter learned her second life lesson - my wife was taking her turn, and she picked a card that gave her the opportunity to buy an investment. The investment would cost her $600 dollars but it would give her a recurring income of $10. Now I was the bank and my 5 yr olds helper so I simply watched the game and observed much of what was going on. My daughter quickly blurted out to her mom: " don't buy that investment it cost too much and you get only a little bit of money!" My wife was quickly taking the advice of my daughter so I explained to my was that it was her choice if she wanted the investment or not, but that every time she was paid her salary, she would also get an extra $10 dollars. My wife thought about it and then said " sure why not, it's not real money."

After a few turns my daughter learned her second life lesson - my wife was taking her turn, and she picked a card that gave her the opportunity to buy an investment. The investment would cost her $600 dollars but it would give her a recurring income of $10. Now I was the bank and my 5 yr olds helper so I simply watched the game and observed much of what was going on. My daughter quickly blurted out to her mom: " don't buy that investment it cost too much and you get only a little bit of money!" My wife was quickly taking the advice of my daughter so I explained to my was that it was her choice if she wanted the investment or not, but that every time she was paid her salary, she would also get an extra $10 dollars. My wife thought about it and then said " sure why not, it's not real money." It's funny how the mind works, when it's a game, paper money, it is not that hard to step out and invest. But once your in the real world, some how paper money has more value, fear of loss attached to it and a completely different sense comes over you.

It's funny how the mind works, when it's a game, paper money, it is not that hard to step out and invest. But once your in the real world, some how paper money has more value, fear of loss attached to it and a completely different sense comes over you. The reason behind saving, trying to build wealth [ mainly assets that will create income for us to live on ] is because I love her. Because I want to supply her needs, even some of her wants, today, tomorrow and for as long as she lives. Because I save or cut down on waste doesn’t mean I don’t want to buy her things - it just means I have goals, priorities and I want to achieve those goals for us, the kids, for her.

The reason behind saving, trying to build wealth [ mainly assets that will create income for us to live on ] is because I love her. Because I want to supply her needs, even some of her wants, today, tomorrow and for as long as she lives. Because I save or cut down on waste doesn’t mean I don’t want to buy her things - it just means I have goals, priorities and I want to achieve those goals for us, the kids, for her. I think that song from Erick Clapton, where he sings “ If I could change the world “ sums it up best for how I feel about my family. I can’t change greedy corporations or the men that run them. I can’t change corrupt government or the over baring taxation we face. I can not change the cruelty of this world, but I can change the way my kids think. How they work with their hands, money and teach then how to have their money work for them. My kids can do what ever they want to do in life, but I know that they can’t say that dad didn’t try to teach them a better way. Instead of being an employee be the owner. Instead of buying junk, buy a business. Instead of being a slave to taxation - play by the governments rules and pay less taxes?

I think that song from Erick Clapton, where he sings “ If I could change the world “ sums it up best for how I feel about my family. I can’t change greedy corporations or the men that run them. I can’t change corrupt government or the over baring taxation we face. I can not change the cruelty of this world, but I can change the way my kids think. How they work with their hands, money and teach then how to have their money work for them. My kids can do what ever they want to do in life, but I know that they can’t say that dad didn’t try to teach them a better way. Instead of being an employee be the owner. Instead of buying junk, buy a business. Instead of being a slave to taxation - play by the governments rules and pay less taxes? In truth, my business is to teach my children about money, parents often never teach children about money - they leave it up to the school or life in general to teach children about money. I don’t want that for my kids. I want to teach my kids about money - I want them to know how to manage money, make money, make money work for them, even how to create money from nothing.

In truth, my business is to teach my children about money, parents often never teach children about money - they leave it up to the school or life in general to teach children about money. I don’t want that for my kids. I want to teach my kids about money - I want them to know how to manage money, make money, make money work for them, even how to create money from nothing. Earlier that morning we were watching the news before taking the kids to school and going off to work. There was a report on a special event in Tampa Florida that many banks were holding in order to help families who were losing their homes to Bank foreclosure. They talked with one particular sweet looking elderly woman and her husband… the elderly woman said “I worked all my life to get my dream home and retire… it looks like I worked all my life for nothing….” Between health problems and the bank foreclosure - this sweet elderly woman was losing everything she worked hard all her life for.

Earlier that morning we were watching the news before taking the kids to school and going off to work. There was a report on a special event in Tampa Florida that many banks were holding in order to help families who were losing their homes to Bank foreclosure. They talked with one particular sweet looking elderly woman and her husband… the elderly woman said “I worked all my life to get my dream home and retire… it looks like I worked all my life for nothing….” Between health problems and the bank foreclosure - this sweet elderly woman was losing everything she worked hard all her life for.

The reason people are poor, can never truly get ahead is because they always pay everyone else first and by the time they are done - they have nothing left for themselves. Nothing ….

The reason people are poor, can never truly get ahead is because they always pay everyone else first and by the time they are done - they have nothing left for themselves. Nothing ….