Cultivating a business with your eyes wide open ?

People are always telling how me impossible it is to make money. I mention to them how they should teach their kids about money, how they should change their own way of thinking about money - and I get all these stories how impossible it is. Well, here is a story in the newspaper how a gentleman found a new way to make money simply by opening his eyes and his mind.

The gentlemen I am speaking about is Mr. Bill Kurek, apparently he has driven the same road and route for over forty years and one day he simply opened his eyes, saw something [ in this case signs that have been there since the town was founded ] and his mind finally woke up and said “maybe I can do something with this “. It’s a short synapses of his success but you get the point.

Quote : LAKE PLACID - Bill Kurek had been coming here from Broward County for 40 years, and he kept passing the sign that boasted Lake Placid was the caladium capital of the world.

And even though he retired in July 2002, Kurek said to himself, "I ought to be able to do something with caladiums."

He wasn't a salesman; he was a project manager for a company which installed fire alarms. "I managed crews that installed systems in high rises and hospitals," he explained.

But he went to the Internet and typed "caladiums."

"I almost fell out of my chair when I realized how much people were paying for caladiums," he said. "I've got to be able to sell bulbs cheaper than this."

“

Cultivating a business” By GARY PINNELL / Highlands Today

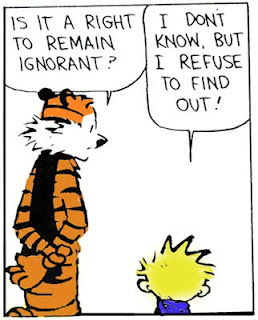

Open your eyes [ mind ] or be open to opportunitiesSometimes it sounds like a whole bunch of hogwash - the rich guru person telling you that you have to envision wealth first because you have to believe it first before you can become a success. Yes it sounds ridiculous but in part it is truth…

Many people go thru life never noticing the obvious, that which is right in front of them. They lose opportunities for love, joy, happiness and even prosperity because their simply oblivious to what is right there before their very eyes. Others simply can’t seem to believe that the opportunity of love, joy, happiness or prosperity in front of them is possible because they some how refuse to believe they can achieve that love, joy, happiness or prosperity. Then again, some simply wont take the step, work or risk to reach out and grab for that opportunity.

So in part - all those “gurus” selling the principal of “think and believe it” first speeches are in part - correct.

Teaching kids about money means moreMy post are mostly about teaching kids about money, that as parents we have the responsibility to teach our kids about money. Teach them how to make money, how to manage money, how to think about money and all the different things that go along with it like investing, starting a business and so forth.

One of the most important things I try to teach my kids about money is that it all starts in their mind first.

Not that I am trying to teach them some fancy guru’s belief of “see it and you can achieve it “ nonsense. I want them to understand that just like Mr. Bill Kurek , an opportunity could be passing them by simply because their not open to it. I try to teach them 4 basic principals that they can use in everyday life:

1- never say you can’t - no, always say; how can I do or achieve thisToo many people say they can’t without even trying first. If you train yourself to think that everything can be done, that you simply need to find the solution to “how” then your less likely to give up without trying. Everyone knows the story of Tomas Jefferson - how many tries did it take for him to invent the light buld - 2, 3, what 1,000. But what we really should consider is - what if he would have thought: "light bulb, that is impossible. Why even try. "

2- it’s too late, it’s already been done - no; say, how can I improve this or benefit from thisMr. Bill Kurek could have easily thought, hey this is an old idea, to many people are already doing this and kept on driving, but he thought to himself, how can I sell this cheaper [ meaning - how can I improve on this ]

The Bible is more than two thousand years old and it says “there is nothing new under the sun” - trust me nothing is new. I heard someone describe the Iphone as just a touch ipod that makes calls. Which came first the iphone or the ipod ?????? … the ipod.

3- I give up, no; say - I need help or I’ll come back to thisMany people get excited about this or that and when they run into trouble they soon give up - it doesn’t matter how close you come to success, if you don’t accomplish success - failure is still failure.

How many stories have we heard about millionaires who become rich because they took someone else’s efforts and made millions while the creator of that product or idea is still poor. Microsoft - it’s said that Bill Gates didn’t create the program he bought it from someone [ do you know that mans name ??? No… ]

McDonalds - Ray crock bought the rights to franchise the McDonalds concept [ with fast hamburgers ] McDonalds is worth billions - and what happened to the McDonald brothers ????

My life, your life, everyone has a story about an opportunity they let slip by because we gave up, because we couldn’t capitalize on an opportunity. We will always say - I almost, I tried, but we fail to say - I never went the extra mile, I didn’t seek out help. We failed because we gave up. We failed because we thought it just couldn’t be done.

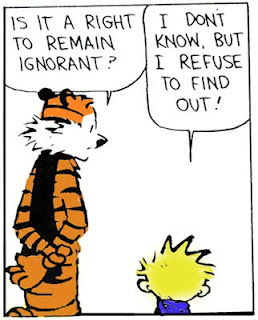

4- I don’t understand, no; say - I’ll take time to learnMy children come to me and always say the same thing -”dad, help me with this. I don’t understand it”. Like most children, what they really mean is - dad can you do this for me.

I always try to teach my kids through hands on approach [ meaning they have to do it in order to learn ]. It does not matter if it is homework or life’s lessons - they have to process it, learn by thinking and doing - they will not learn from me giving them the answers.

The reason people lose money in the stock market is because we just don’t take the time to learn. Why do people fall for email scams about some unknown face saying they will give you 10 million dollars if you send them $400 dollars to transfer money from Africa to America…. We do not stop to think, investigate, learn - we just react.

Most people have car insurance - they don’t know why they have it, some even hate it, but they have it. Did you know that even though the stock market is risky, you can buy insurance on your risky investment [ I bet your mutual fund advisor doesn’t tell you that ].

The next time you see your child struggling with homework, or you have an opportunity to teach that child about money - help them open their eyes and their minds. Because believing is not enough, but if you keep an open mind, look to find answers, never give up, ask for help and learn what you need to learn to be a success - your chances of success are a lot greater than you think.